News & Press

Weng Fine Art Stock Price Doubles After IPO on Frankfurt Stock Exchange

27 Jan. 2012 / Pressespiegel

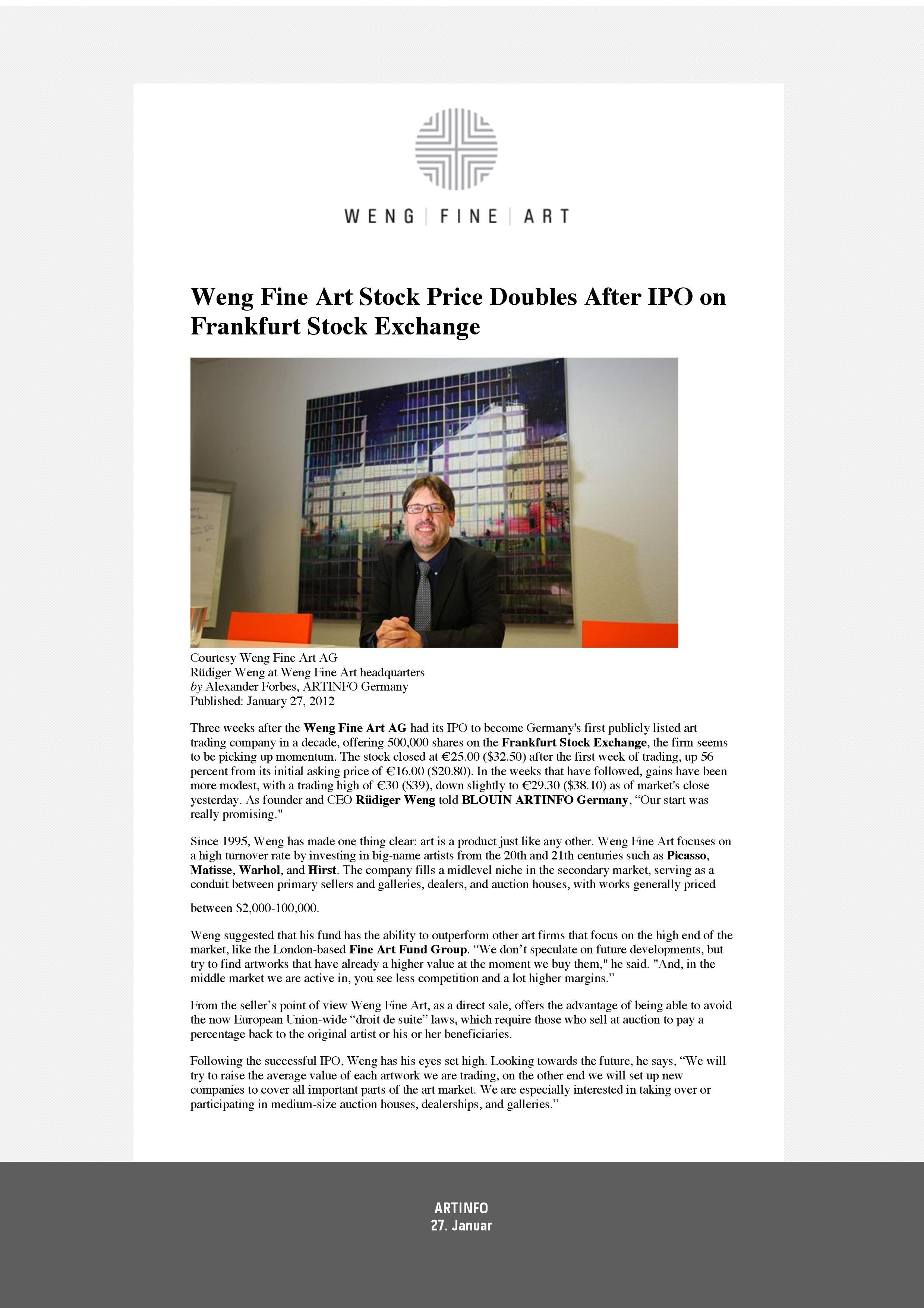

Three weeks after the Weng Fine Art AG had its IPO to become Germany's first publicly listed art trading company in a decade, offering 500,000 shares on the Frankfurt Stock Exchange, the firm seems to be picking up momentum. The stock closed at €25.00 ($32.50) after the first week of trading, up 56 percent from its initial asking price of €16.00 ($20.80). In the weeks that have followed, gains have been more modest, with a trading high of €30 ($39), down slightly to €29.30 ($38.10) as of market's close yesterday. As founder and CEO Rüdiger Weng told BLOUIN ARTINFO Germany, “Our start was really promising."

Since 1995, Weng has made one thing clear: art is a product just like any other. Weng Fine Art focuses on a high turnover rate by investing in big-name artists from the 20th and 21th centuries such as Picasso, Matisse, Warhol, and Hirst. The company fills a midlevel niche in the secondary market, serving as a conduit between primary sellers and galleries, dealers, and auction houses, with works generally priced between $2,000-100,000.

Weng suggested that his fund has the ability to outperform other art firms that focus on the high end of the market, like the London-based Fine Art Fund Group. “We don’t speculate on future developments, but try to find artworks that have already a higher value at the moment we buy them," he said. "And, in the middle market we are active in, you see less competition and a lot higher margins.”

From the seller’s point of view Weng Fine Art, as a direct sale, offers the advantage of being able to avoid the now European Union-wide “droit de suite” laws, which require those who sell at auction to pay a percentage back to the original artist or his or her beneficiaries.

Following the successful IPO, Weng has his eyes set high. Looking towards the future, he says, “We will try to raise the average value of each artwork we are trading, on the other end we will set up new companies to cover all important parts of the art market. We are especially interested in taking over or participating in medium-size auction houses, dealerships, and galleries.”

ARTINFO GERMANY | 27. JAN 2012 | VON ALEXANDER FORBES